Softeq Development is involved in everything mobile: from business apps, digital imaging and utilities to mobile games, wearable technology, sensor-rich equipment and its remote management. They have built dozens of embedded solutions, web, and mobile applications for such clients as Nike, NVIDIA, Omron, AMD, Atlas Copco, EPSON, Disney Parks and Resorts. T. Our associate author, Alkis Polyrakis, discussed with Softeq’s CEO, Chris Howard.

What is the philosophy that you employ in order to assist companies take advantage of the full potential of the latest technology?

To me, our philosophy is to be ahead of the curve. It means we try to know and adopt new APIs, tools, and technologies before customers actually need it. We obtained and evaluated Google Glass, EPSON Moverio, Oculus Rift, LEAP motion controller and many more new tech novelties long before the first project came along. Once a customer approaches us with a project for those new technologies, Softeq is already the most competent tech provider the customer can possibly find on the market. Having close ties with many companies in Silicon Valley, we were one of the first tech firms in the world to access and implement, for example, Microsoft’s high speed video APIs on Windows Phone before they were available to the public.

What are the benefits of implementing a Proof of Concept in business projects?

A proof-of-concept (PoC) is a great first step on the way to a new product, device or technology that was never seen before because it’s a low-risk and low-investment approach. Often, it requires a 10-20 times smaller budget than actual new product development.

In our business, we have come across two different goals, or approaches if you like, to building PoC apps. One is when a customer is looking to prove the feasibility of his new business idea. At times, our clients need to demonstrate a working prototype of an upcoming product at a trade show, board meeting, or at an investor meeting. Prototypes later can become Minimum Viable Products (MVPs) and both can be stages of a full product development cycle if the idea gets approval.

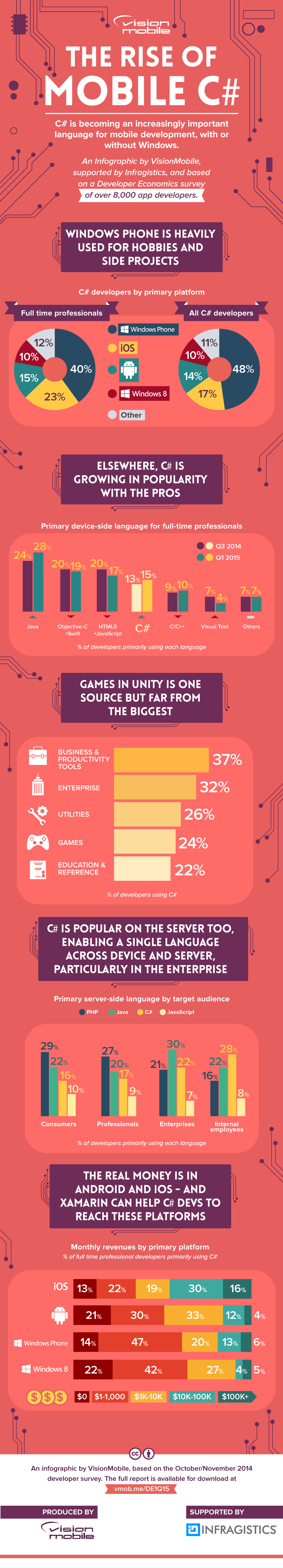

| Xamarin framework | Business apps development |

| Atlassian Jira | Project management |

| LabView – LabWindows – MathLAB | Wearable devices |

| Flurry – Google Analytics – Localytics – Adjust – Parse | Monetization |

| Unity | Games development |

Softeq’s Toolset

The second typical need is when a technically advanced company researches next-gen ideas, software or hardware they’re looking to jump into. Here, building a proof-of-concept in the first place is a way to test the feasibility of their vision for the application of new technology, a hardware component, or form factor. Just like that, our R&D teams have been working for Nike, Intel, and EPSON to help then visualize their new ideas and prove it is actually possible to do what they envision.

Do you have a specific development procedure when working on a PoC?

As a PoC is always something pretty innovative and non-standard, generally the development procedure is to identify the key features of what a client is trying to do in a bigger project, focus on only testing and proving out the specific new APIs or new hardware, and building a very simple framework in order to demonstrate that specific capability. After the PoC is approved by the management team, the investor, or the end-client, we proceed to flesh out the rest of the features and ship an actual product.

Which development and project management tools do you employ in order to facilitate your needs in cross platform development?

There are several cross-platform frameworks trending on the market now, and this is fair enough. The mobile market is no longer dominated by one platform, and most of our customers, both in the B2B and B2C segments, need to target wider audiences with various OS preferences. We use the C# based Xamarin framework for business apps, and Unity for games. Speaking of project management tools, we use Atlassian Jira by default or any other tool the client is more comfortable with.

Our readers would like to hear some examples that show how you managed to pump up a company’s marketing efforts with your apps.

Marketing apps vary, and we’ve delivered several dozen of them: from Blizzard’s BlizzCon event management app for helping improve the guest experience, to mobile CRM, promotional games, mobile magazines for corporate clients, and demo apps for tech events and industry-specific trade shows and all the way up to international tech summits and even Mobile World Congress where companies present their new or would-be products. We’ve built several kiosk apps for in-store demonstration of new gadgets to buyers. One of them was for NVIDIA’s SHIELD – the world’s first Android TV console. The kiosk mode allows demonstrating all functional features, including games, videos and music playback, while blocking access to system settings.

What are the main challenges that you face when you attempt to build solutions for wearable devices?

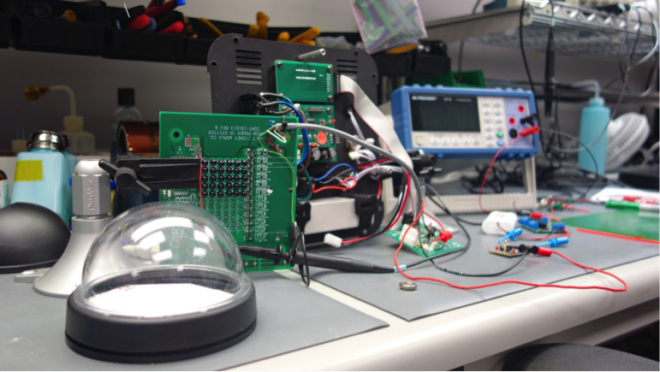

We’ve been working on embedded devices for a very long time, over 15 years now, that’s why the era of wearables came very natural to us. The challenges anyone designing a wearable device inevitably faces are technical limitations of the form factor, such as short battery life, small amount of memory, insufficient performance, custom communication protocols (infrared, Bluetooth low energy) and more.

However, Softeq is uniquely positioned in this market and beyond, in the Internet-of-Things (IoT) space, because we do everything from hardware, low-level and firmware to web backends and mobile apps covering all our departments end-to-end. To extend that further we have a game department, and that even gets mixed in with wearables and the IoT.

Can you tell us about some of your wearable device projects and the tools that you employ?

One of our current projects involves embedded touch panels, and we do both firmware for the panels and Qt-powered games for them. Another product we helped create – the BlinkFX Wink, which is a wireless control LED light wearable device – is being used for an upcoming game show at CBS.

There’s a wide range of tools and instruments, mainly in C, that we use for such projects. For instance, recently we started receiving multiple requests for projects involving drones. We suggest using such behavior modelling tools as LabView, LabWindows and MathLAB, but it’s not the tools that matter most. The most complex part is building math models and algorithms based on them.

Do you provide consulting services as to which model can maximize a game’s revenue?

The monetization system of a game is usually built by a tandem of experts – a game designer and a marketer. The game designer is responsible for building game mechanics in terms of monetization and balancing economics while the marketer drives user acquisition campaigns.

To ensure we deliver the maximum amount of effort on our end to ensure the game’s success, our game designers invest a lot of time in research, comparative analysis of top apps, exploring best practices and efficient mechanics to put them in our arsenal. From the game design perspective, we certainly consult developers at the early stages of building the monetization system: building the core loop, the in-game store, retention mechanics, economics balance, analytics, A/B testing system implementation, etc. For instance, we work with such analytical tools as Flurry, Google Analytics, Localytics, Adjust, Parse and the selection of tools depends largely on the game specifics and client’s preferences.

Thank you very much for taking the time to share your strategy with our readers.