Biggest developer survey

We’re thrilled to announce that the Q2 Developer Economics survey we conducted throughout April was the most successful to date, zooming past the 6,000 respondents mark, making it the biggest developer survey globally.

UPDATE: The survey results have now been published – download the free report here.

We broke through the 6,000 developer mark mainly thanks to the help of our 48 Marketing and Regional partners. Together we reached developers from an unprecedented 115 countries, from mature markets, like the US and Western Europe, to emerging markets, like Brazil, Russia, India and China. To reach developers on a global scale, we translated the survey in 10 languages (Arabic, Chinese, French, German, Japanese, Korean, Portuguese, Russian, Spanish, and Swedish), aided by our local partners, who helped us reach the local dev communities. Thanks to a partnership with Mobile Monday, we also promoted through over 20 local MoMo chapters in Asia and Oceania.

In the next two months we ‘ll be diving into the results of the survey. The Developer Economics state of the developer nation report will be launched in July, as a free download thanks to the sponsorship by BlackBerry, Mozilla, Intel and Telefonica. This 5th incarnation of the Developer Economics report will feature the latest market trends, including Developer Mindshare and Intentshare, platform selection criteria, revenue models, revenues per app and many more. To whet your appetite until the July launch, you can read the previous editions of the Developer Economics report.

To be the first get the Developer Economics 5th Edition report, sign up for our mailing list!

Sneak peek on Mindshare: Android, iOS duopoly entrenched – with HTML closely behind

Our early results from the Q2 app developer survey are starting to come in – starting with the Developer Mindshare Index 2Q13, i.e. the percentage of mobile developers using each app platform.

As you can see in the graph, the use of Android and iOS is still predominant, with a few percentage points of change for both platforms when compared to our 4Q12 survey. You’ll also notice the continued growth of HMTL as the third horse in the platform race, slowly creeping up on iOS. These trends have been steady over the past year – but what do they mean?

The continued positioning of Android and iOS as the top two platforms is a no-brainer: Android has the largest installed base and iOS enjoys the highest revenue potential overall – so why does HTML5 continue to grow?

HTML5 grows in popularity as large groups of web developers are leaping over the ever-shrinking chasm from desktop to mobile apps. Moreover, HTML5 allows for the development and deployment of apps that work across different platforms, usually at a lower cost of developing HTML apps, and for most app categories. About two thirds of developers targeting HTML mobile develop web sites or web apps while just under a third are using PhoneGap. Stay tuned for more analysis on the route to market for HTML5 apps in the full report.

HTML5 has wide industry backing across telcos, handset makers and platforms (Firefox OS, BlackBerry WebWorks and Tizen) going for it. At the same time, there are certain key disadvantages, namely access to native platform APIs, as well as the lack of a unified development environment and quality debugging tools.

HTML5 is now challenging the duopoly as a development or deployment platform – with the route to market varying across browsers, hybrid apps (e.g. PhoneGap), JavaScript converters (Appcelerator) and dedicated platform frameworks (BlackBerry WebWorks). We still see a growing diversity in the go-to-market approaches for HTML5 developers, and one which we believe will continue to expand. We‘ll be analyzing the HTML vs. native tradeoffs in a future report, but in the meantime – what’s your take on the HTML vs. native debate?

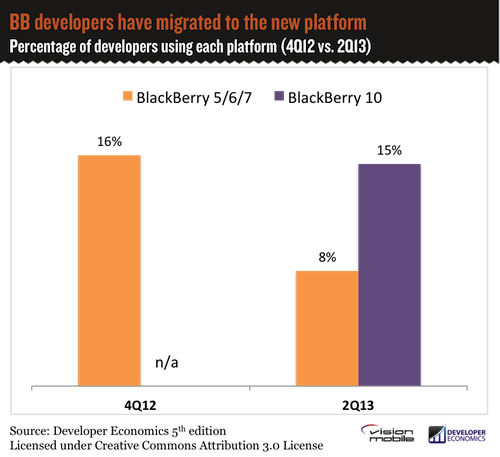

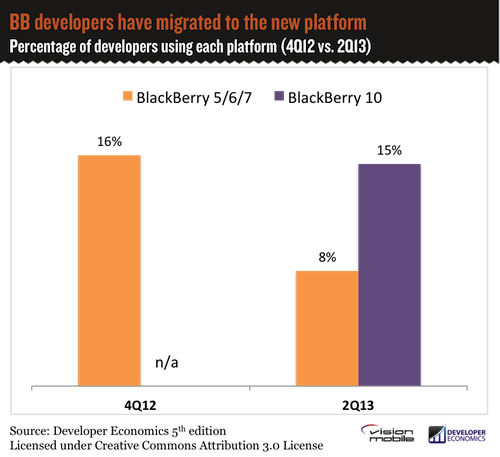

Sneak peek: Windows 8 and BB 10 are gaining traction

As you can see from the early Developer Mindshare graph, Windows 8 and BlackBerry 10 have already attracted a reasonable amount of developer attention. What’s important here is that BlackBerry developers have been quick to migrate from the old legacy (5,6,7) platforms and adopt the latest, BB10 platform.

What’s interesting to note in the graph above, comparing the use of BB platforms between the two latest surveys (4Q12 vs. 2Q13) is the fact that the BB 5,6,7 platforms are quickly fading into oblivion, with BB10 mushrooming to a substantial 15% mindshare in just 6 months. The mindshare of BB10 is slightly less than that of BB 5,6,7 six months ago, but the platform is still gaining in strength, as our data for the platforms that developers plan to adopt seem to suggest, so there’s room for growth. The extent to which the new BlackBerry platform can grow in Developer Mindshare depends primarily on the volume of devices that BlackBerry will manage to sell in the coming months, given that reach is the primary reason for platform selection.

Competing against Windows Phone and BlackBerry 10, new entrants Firefox OS and Tizen are slowly gaining support from a few handset OEMs and network operators. Another open question is whether the HTML5 platform proponents – Tizen, Firefox OS and BlackBerry WebWorks – should band together towards a single HTML5 implementation or keep pursuing independent and conflicting strategies. What’s your take?

Full report available in July

We’ll be stopping our sneak peek here – stay tuned for the full report for more (out in July)! There, you’ll find an in-depth analysis of major trends, such as the shifting balance of power between the top platforms, devices vs. tablets, revenue models, as well as the main factors affecting app monetization. If you haven’t already done so, subscribe to our mailing list to receive word of the report publication.

Until next time,

– Matos (@visionmobile)