As mobile apps become more sophisticated and expand their user base, the requirement for remote storage and user management becomes more important in terms of both functionality and scalability. This capability is usually provided at the backend that manages the application data. Off-the-shelf mobile Backend-as-a-Service can save a considerable amount of time for developers that require backend support for their apps. At the very basic level, mobile BaaS services offer a managed, cloud-hosted database that scales as the user base grows. All BaaS services provide additional functionality on top of this basic layer that may include user management, push-notifications and large-file storage among other.

Backend services used by 14% of developers

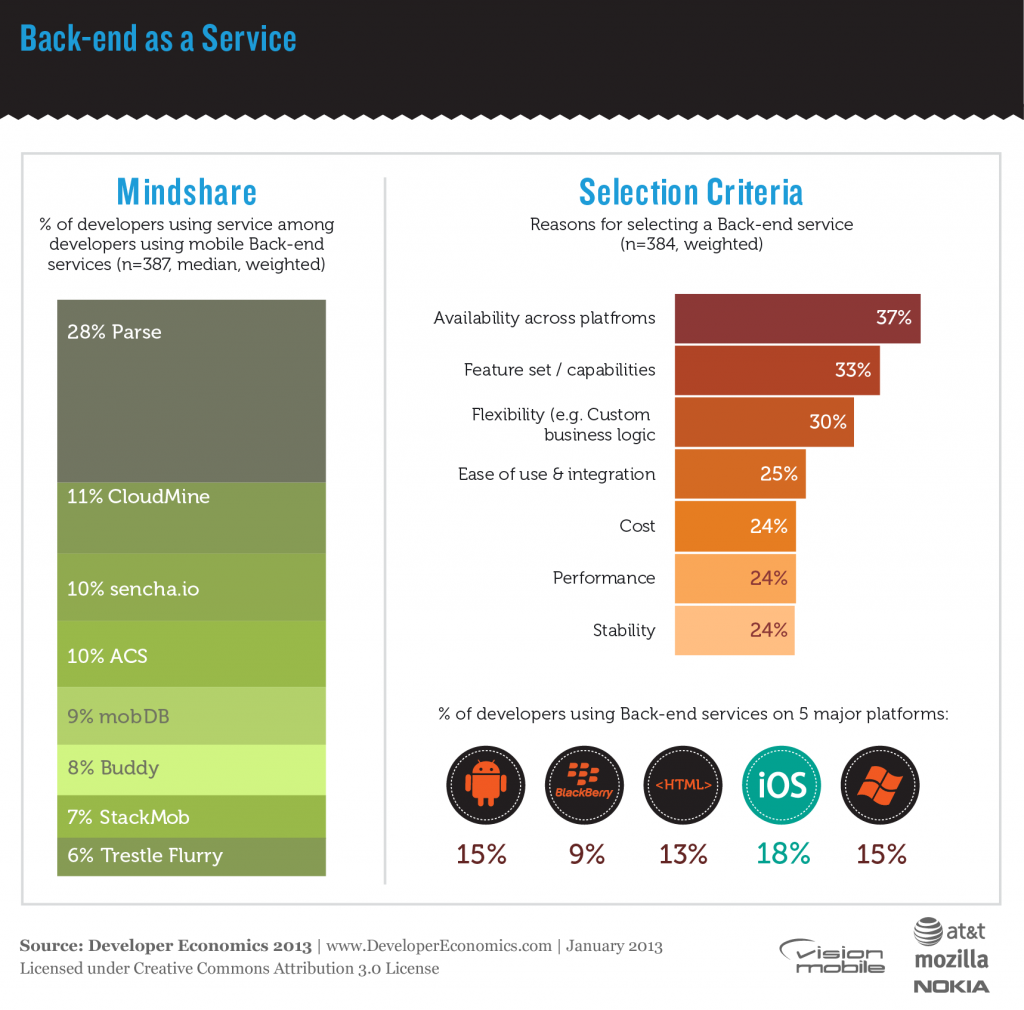

Backend services are currently used by 14% of developers, but their use is more frequent among developers working on 16+ apps per year (25%). Backend services are used slightly more on iOS (18% of iOS developers) than on Android or WP (both at 15%), while BlackBerry developers use these services much less (9%), perhaps as a result of limited support among these tools for BlackBerry.

Parse in the lead

The clear leader in the BaaS sector is Parse, considered by many as the de-facto BaaS provider and used by 28% of all BaaS users, followed by enterprise-focused CloudMine, used by 11% of developers. Sencha.io and Appcelerator, both commanding a 10% share among developers using BaaS, are solutions that are well integrated with their corresponding development frameworks (Sencha and Appcelerator) and therefore not directly competing with services such as Parse or StackMob. While the BaaS market is crowded, services address different niches that differentiate them among competitors. As a result we have yet to see any service dominating the sector to the extent observed in other developer services such as advertising or user analytics.

While the core features may be common among BaaS providers, there are significant differences and advantages to each of these services that may make the selection easier. For example, exporting data may not be available on all services so if this is a key requirement, then a number of these services can be ruled out. Developers often find BaaS restrictive for their application requirements so several BaaS providers such as Parse, CloudMine, StackMob and Kinvey allow developers to implement custom business logic. However, developers frequently opt for a custom-built backend solution rather than a BaaS for greater flexibility.

Selection criteria

The main selection criterion for developers is, as in most third-party developer services, availability across platforms. However, the richness of the feature set is almost equally important as is the flexibility of the service, e.g. the ability to implement custom business logic. Ease of integration and use, stability and performance are important to 25% of developers using backend services.

Another important aspect of backend services is the pricing flexibility, i.e. the way costs scale with usage. Many developers whose apps experience a sudden surge in user base may find it extremely difficult to scale their costs as usage grows: a free service using a third-party backend that suddenly amasses hundreds of thousands of users will incur significant operational costs as access to the backend rises with the number of users. Developers should keep this in mind when designing their apps and backend service providers should aim to align pricing strategies with developers’ business models.

Backend features

We asked developers using backend services to highlight the most important feature for them. 28% (of developers using backend services) indicated data management and 18% indicated user management and authentication. Next most important features are push notifications and content management highlighted by 11% of developers using backend services. Less important features include analytics (9%), file storage (7%), cloud code (custom logic) (6%) and social graphs (3%).

The backend service sector is relatively young and expected to grow as developers familiarise themselves with such services and realise their potential. At the same time, there is much room for improvement as BaaS providers better understand and adapt their services to developer needs such as flexible and customisable business logic.

[doritos_report location=’DE13 Article – BaaS’]

Which BaaS services are other developers using?

[toggle title=”Important things to know about this interactive graph”]

- All the filters in the graph refer to survey questions in which respondents could select multiple answers. This means that there is no direct link between the filter and the use of the tool. For example, filtering on “Android” means that the respondents develop Android apps. It doesn’t imply that they use the tools for their Android apps specifically, or even that the tool supports the Android platform. Use filters as a guideline only.

- Keep an eye on the sample size. If the sample size is low, the graph doesn’t offer strong conclusions about the popularity of different tools. Use your good judgment when making decisions.

- In this graph, “Other” was removed as a possible answer. A lot of respondents used the “Other” answer to indicate that they use an in-house solution, which is not a “Backend-as-a-Service” at all.[/toggle]

Find the best BaaS service for you!

[sectors slugs=’backend-as-a-service’]