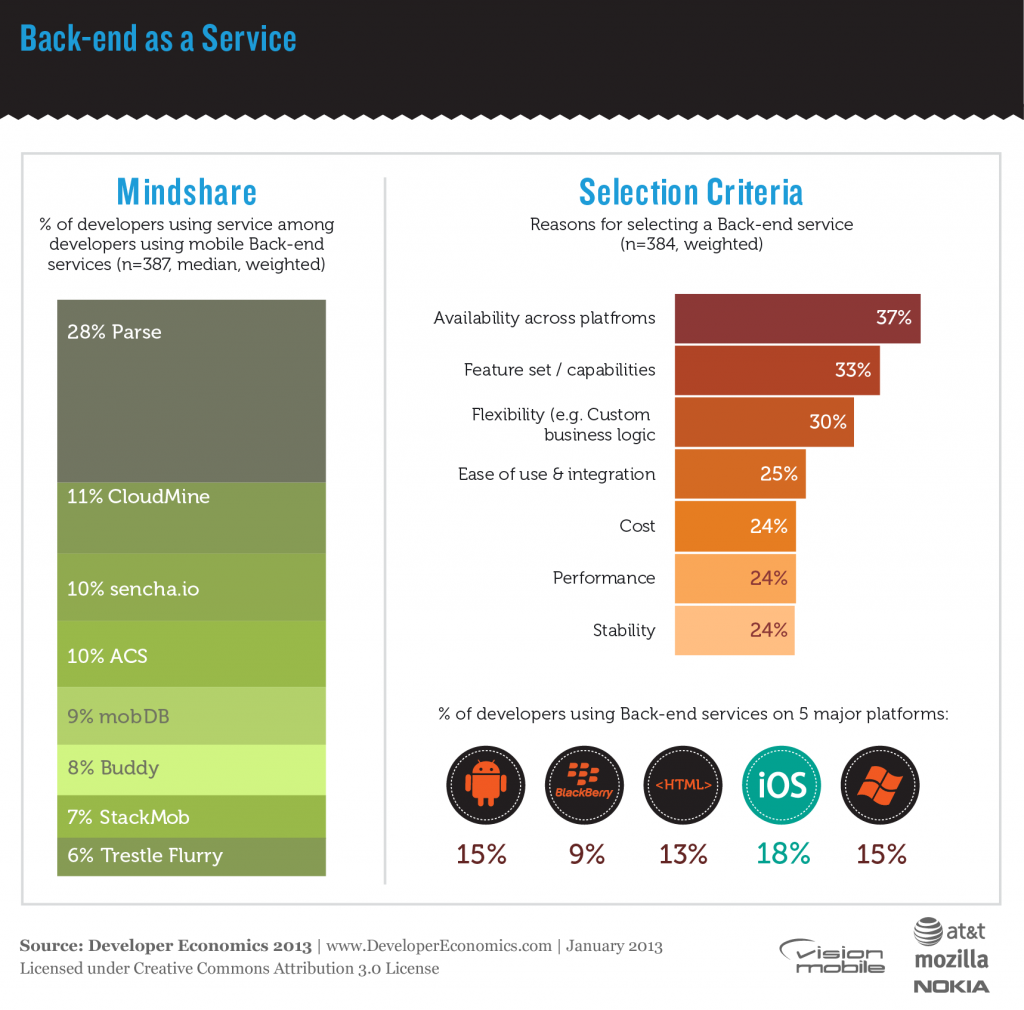

Using a Backend-as-a-Service (BaaS) can reduce development cost and time-to-market. It’s a simple way of getting a highly scalable backend solution without significant upfront investment. This avoids the technical risks of having to scale your own service to meet demand as your user base grows; in a world where an app that hits the store top charts might gain more than a million new users before you complete your next iteration of development this is worthy of serious consideration. In most cases the tradeoff is giving up control of your backend. This tradeoff was brought into the spotlight recently when the most popular BaaS, Parse, was acquired by Facebook. This created a predominantly negative reaction from developers who went from buying a service from a neutral party to hosting their backend with someone many already distrust that has an interest in mining their app data. So, if you’re looking for a BaaS for new project but don’t want to share your data with Facebook, or want to migrate away from Parse, where do you go? Our last survey asked developers using BaaS offerings to rate their primary tool against a range of criteria – the results could highlight some attractive alternatives.

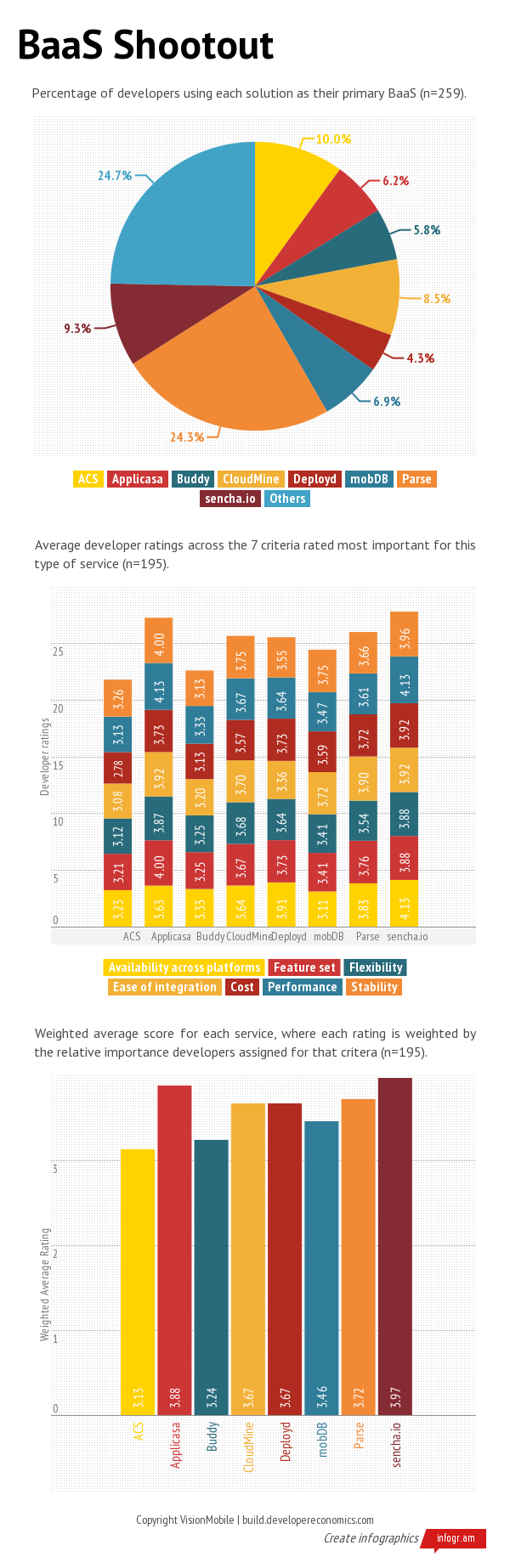

Splitting out the 8 tools which had more than 10 ratings each, the “other” category is still almost 25% of responses and includes a further 11 tools that developers had selected as their primary BaaS. Our own sector page lists 43 vendors at the time of writing, suggesting that the sector is still very fragmented and likely to see consolidation in future.

Some popular BaaS options tied to other tools

Parse was by far the most popular with almost 2.5 times as many responses as Appcelerator’s Cloud Service as the next most popular. Appcelerator’s service is fairly heavily tied to their popular Cross-platform tool (CPT) much like the Sencha offering, which had a very similar number of responses. However, while Sencha’s BaaS had the highest developer satisfaction in our survey, Appcelerator’s was the lowest of the top eight. This situation is the same as the satisfaction levels for the corresponding CPTs. While sencha.io may look attractive on developer ratings, adopting it implies using (at least some of) the Sencha libraries for cross-platform web development too – although this tool scored highly on cross-platform availability (the web works everywhere) there are no native SDKs.

Applicasa switched focus

Just behind sencha.io for developer satisfaction was Applicasa. However, while our survey was running Applicasa were in the middle of a mini-pivot from a generic BaaS to a “Mobile Game Management Platform”, having recognised that the generic BaaS sector was exceptionally crowded. They haven’t yet come out of beta or announced pricing, although this is likely to reflect their value-adding services for game developers. If you’re looking for a BaaS offering with extra functionality for mobile games then Applicasa may be worth a look.

Open source or specialised

Behind Applicasa comes Parse, closely followed by Deployd and CloudMine. Deployd does not yet have a production hosting solution, so it’s currently just an open source project that you host your own instance of on Heroku or Amazon. That’s also an advantage in that you can modify the code and you’ll always control your own data. Another open source BaaS option like this, Helios, was recently launched by Heroku themselves. If you can take on responsibility for some of the maintenance of the backend in order to maintain control of your backend code and data then this kind of open source option is very attractive. CloudMine on the other hand is focussing on larger corporate clients – they’re targeting enterprises and agencies producing lots of apps. Like Applicasa, they’re specialising to target what they see as a more profitable niche and trying to avoid mass market generic BaaS competition.

Further acquisitions likely – select with care

The remaining popular BaaS options in our survey scored below the average for “others” on developer satisfaction. However, just by looking at the top handful we can see some trends for the still immature sector emerging. The generic BaaS space is all about scale. The remaining vendors fighting for this market are likely to get acquired by a larger company, or run out of cash trying to compete. It was implied that there were multiple parties interested in acquiring Parse who are presumably still in the market for a similar solution. If the acquiror of your chosen BaaS is a PaaS vendor then the service should continue to evolve and developers’ data remain private. The large PaaS vendors are likely to build or buy a more complete BaaS solution – we already see this with Helios and Windows Azure Mobile Services. Other companies interested in buying a BaaS vendor might want to integrate with their own analytics (as with Flurry buying Trestle) or other developer services, secure a key supplier or just get a closer relationship with mobile developers. There may also be large enterprises that snap up a small BaaS vendor for their own internal use. Other BaaS vendors will specialise towards specific developer segments.

If, like most developers, you’re still experimenting in the market and not yet building your own services with a long term view then a BaaS that’s specialised to your app category might be a great option. For those looking to select a common backend architecture that they’ll re-use across multiple products, or platform to build on top of for the longer term, the open source frameworks look like the safest option in the current market.