Developers are makers. They solve pains, entertain, enlighten, and enhance productivity. Building an app can be an exhilarating experience and the joys of shipping can linger for… about ten seconds. Then comes the question, “I’ve built an app, now what?”

“Building an app is incredibly hard,” said Brenden Mulligan, former LaunchKit founder, which was recently acquired by Google. “But getting people to use it is an even bigger challenge. Once an app is released you start getting so many signals of how it’s doing, and it’s important to have the right infrastructure set up to receive and learn from those signals. Things like user activity, app store reviews, churn… In addition, devs have to be thinking of the next feature, or bugs they need to fix.”

Earlier this year, Ægir Thor Steinarsson and Anne-Marthe Lorck built an app to resolve what they were seeing as a common pain point.

“I am a fairly introverted person, and I am a bit disconnected from social groups: I’m studying with people much younger than me, I live in a foreign country. I mostly felt content in my day to day life, but also that I was missing out: I would end up repeatedly cancelling stuff I did want to do, like go to a concert or even a museum, because I didn’t know who to invite,” said Steinarsson.

“We did interviews with about 40 people and found others were experiencing social isolation as well, we asked people to give it a pain grade on a scale of 1 to 5 and we started seeing everyone giving it a high pain point (3 and above). That turned out to be the main theme rather than the exception.”

Steinarsson and Lorck created BudUp as an app to solve that: users can register an event (a concert, movie, dinner party or other activity), and specify the number of people they hope to attend with.

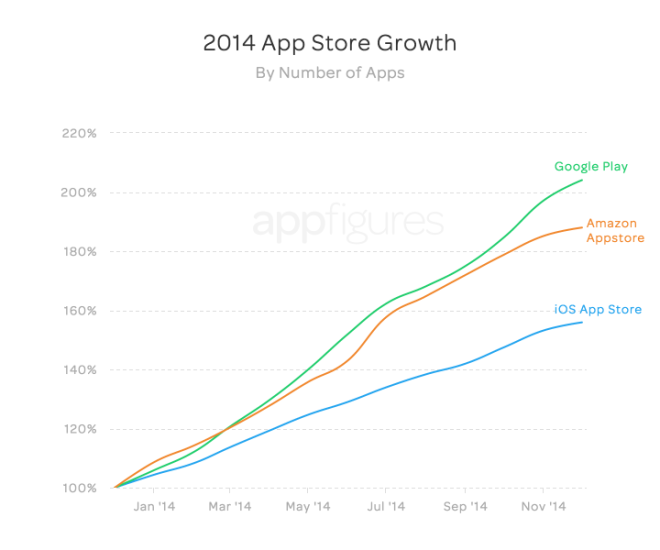

The app was released on the Google Play Store. Android is the main mobile platform for professional developers, according to VisionMobile’s State of the Developer Nation quarterly report, which found that Android accounted for 79% of mobile developer mindshare.

For the BudUp team, while they have plans for an iOS app, for now their focus is all about traction: to get user downloads. As they ramp up their user acquisition, Steinarsson wants to make sure he has data systems in place to know what is happening and to monitor the user experience.

Knowing what to measure and using the free tools that can help developers do that quickly is crucial, said Caroline Ragot, Co-founder of Women in Mobile and Mobile Strategist at InfoJobs, a company of Schibsted Spain.

Ragot says there are two tasks to focus on after building an app: the first is acquisition, which is really about marketing an app.

The second task for a new app is to focus on retention. Ragot says retention is about marketing and the product working together. Analytics underpins an understanding of both these tasks.

Focusing on Acquisition: App Store Optimization (ASO)

Increasing user acquisition for your app starts with app store optimization. 30% of downloads occur after someone has searched by keywords in Google Play. So getting noticed within the app marketplace can already drive up user downloads before looking at any other type of promotion.

Ragot says there are three components in app store optimization:

- text

- icons

- Screenshots

- Review and rating.

Building off the experience of websites in getting noticed, app store optimization makes an impact. Ragot suggests thinking what people will search for when looking for your app, and making sure that those keywords are included in the application title text. “Put the keyword close to your brand,” said Ragot. “When I have done that for app projects, within about two hours I have seen apps move from a ranking of 30-something to a ranking of 8.”

After ASO, the next task is to make sure your icon looks appealing. Don’t believe this is important? Ragot suggests doing a simple app search for something like ‘clock’: “You will see that there will be some you don’t want to download just by looking at them.” In the Google Play console, there is a function to allow developers to A/B test their icons. Ragot suggests testing several and seeing which icon design drives more downloads for your app.

Screenshots are also important. “It’s like the landing page for your app. When visitors arrive, they need to understand what your app is about and it should inspire them to download. It is your first touchpoint with a user,” Ragot explained.

Finally, reviews and ratings make an impact. App stores like Google Play use metrics of downloads and active users as part of their search ranking algorithm, and reviews of apps makes a significant impact on helping encourage searchers to download.

Organic and Paid Acquisition

“The two big acquisition buckets are organic and paid,” said Mulligan, who recently talked about how to optimize app launches with First Round. “Ideally, an app can attract users organically. To do this, there are a lot of ways to optimize a launch to be more successful in initially attracting users. You need to make sure your product name is short and your tagline is clear and concise. You need to figure out what good acquisition looks like for your product and track it from the beginning. You need to bake in marketing hooks that let users share with others how they’re using your app and invite their friends to join them. When the time is right, you need to target the relevant reporters to cover your product and post it to sites with good lead generation like Product Hunt. And the whole time, make sure your line of communication with your early community is very open so you know what’s working, what’s not, and how to change your product to boost your acquisition.”

Other acquisition ideas include Facebook ad campaigns, which Ragot cautions can be expensive, but suggests it is still a good idea to dedicate a small budget of a few thousands dollars to encourage initial traction. Ragot also suggests focusing on social media by encouraging downloaders to share that they have downloaded your app and encourage their networks to do the same.

Steinarsson and Lorck will next focus on content marketing: getting featured in blogs, in particular. They believe when starting to acquire users it is important to do things that don’t necessarily scale in order to maintain an initial personal contact with potential users. They will target several content domains and see in which ones they get traction and focus on those segments to start.

When starting with acquiring users, it can feel like everything is an opportunity cost: choosing one strategy means not investing in another. Setting up analytics to quickly identify what is working is crucial to being able to do more of what works and quickly identify where effort is wasted. Ragot, Mulligan, Steinarsson and Lorck all agree: setting up analytics for acquisition and retention is essential.

And while their strategies are universal across mobile platforms, all three have focused on how to build acquisition with an Android app, reflecting the dominant position of Android in the mobile app developer’s mindshare. According to VisionMobile’s State of the Developer Nation report, 80% of those building apps professionally target Android.

In our next part, we will look at how to retain users once they have started using your app and in part three, we examine what analytics techniques for acquisition and retention to have in place and what free tools to use.

We are currently running our new survey and it is sci-fi themed! Would you like to contribute ? Take the survey