Sebastian Brannstrom, Lead Engineer for Lyft at Zimride, talked to us about their app and the business that the technology enables. Sebastian has been working in mobile software since 2006, initially on Symbian and then transitioning to iOS, Android & Web by way of a side project, created in collaboration with designer and product manager Anna Alfut. In 2011 he joined VC-funded startup Zimride, who at the time only had a handful engineers, to create social ride-sharing services. Zimride’s initial service was an online marketplace for people to sell seats in their car on longer journeys. It was (and still is) growing but relatively slowly by Silicon Valley startup standards.

App Background

The company decided to create a new real-time marketplace for shorter trips and hence Lyft was born in 2012. Lyft has iOS & Android apps with two modes, driver and passenger. Lyft drivers are thoroughly screened, background checked, trained and insured with a $1M excess liability policy. Passengers can use the app to request rides that are tracked by the service, which suggests a minimum donation to the driver at the end. The driver mode notifies drivers of a nearby pickup request and gives them a short time window to accept it before it’s passed to another driver. The whole system enforces use of Facebook for identification to provide some additional security.

Track Record

The concept caught on and quickly became the main focus of the company. The engineering team has roughly tripled in size and the growth of the service is only being limited by how quickly they can recruit, screen and train drivers. Whilst they advertise for drivers on services like Pandora, Spotify and Craigslist, they have never marketed to passengers at all, apart from their signature giant pink mustaches on participating cars. Word-of-mouth marketing at its best, straight out of Seth Godin’s Purple Cow playbook. They have hundreds of registered drivers and tens of thousands of passengers in their first city, San Francisco. The company was nominated for three Crunchie awards and named runner-up in the “Best New Startup of 2012” category. According to TechCrunch, they very recently closed a $15M series B round of venture capital funding and have also just launched their service in a second city – Los Angeles. Open job vacancies make it clear they’re planning significant further expansion.

Competition

The disruption of transportation enabled by near ubiquitous smartphone adoption is an opportunity several startups are attempting to exploit. Lyft faces direct competition locally in San Francisco from SideCar, whilst Uber provide a high end alternative and have stated an intention to create a direct competitor in the lower cost segment. Fairly high-profile competitors with similar technology but not yet competing in the same geographical markets are Heyride, HAILO and Taxibeat, although the latter are enabling existing taxis with similar technology rather than encouraging peer-to-peer ride sharing. There is also indirect competition from existing taxi services.

Business Model

Lyft do not monetize their apps directly, it’s free to download and there are no in-app purchases for new features. Like almost all online marketplaces, Lyft make money by taking a cut of the transactions on the market. In this case the transactions are donations from the passenger to the driver. These are entirely voluntary (which gets around legal issues with drivers using their vehicles for commercial purposes) but the app provides a suggested donation and drivers can set a minimum average donation – passengers that don’t pay much/anything are likely to find no-one will accept their requests very quickly.

Lessons Learned

A successful service is much more than an app. The technology only enables the business at Lyft. Sebastian was quick to point out that the key to the success of the company is the operations team, building a community of drivers and passengers. If they’d simply built the technology and put it out there to see who wanted to use it, it’s very unlikely they’d be enjoying the growth they see now.

Projects will expand or contract to fill the time available to them. The initial concept for Lyft was originally scoped out as an 8-week development for a team of 5 (3 engineers, a designer and a product manager). One of the founders, playing devil’s advocate, said “what if you’ve only got 2 weeks to do it”. This forced them to really cut the concept down to a true Minimum Viable Product. They eventually got the first version built in 3 weeks (server and iOS app) – even today there are still several of their original requirements sitting at the bottom of their backlog unimplemented. The things you think will be essential parts of a service can often turn out to be unimportant for real users.

Team chemistry is essential. It would have been impossible to build such a complex service so quickly without fantastic collaboration. The relationships and collaborative working mode are more important than physical location – Lyft has been hiring top talent from around the world and sorting out visas and relocation to San Francisco afterwards. Sebastian was based in London when he was hired, their iOS lead was in Uruguay and the Android lead in Russia (the extreme time difference was sometimes an issue in the latter case).

What’s in the Lyft toolbox?

Like many successful development teams, Lyft use a lot of third party tools to help build their product:

Also, although they have built their own backend service, creating a highly responsive notification system was a challenge they solved with a combination of polling for updates when sending driver location, the Apple Push Notification Service, Google Cloud Messaging and a paid service from Pusher. However, the latter was initially a source of many crashes due to immature client libraries (Pusher only provide official support for a JavaScript client library, other platforms are community supported).

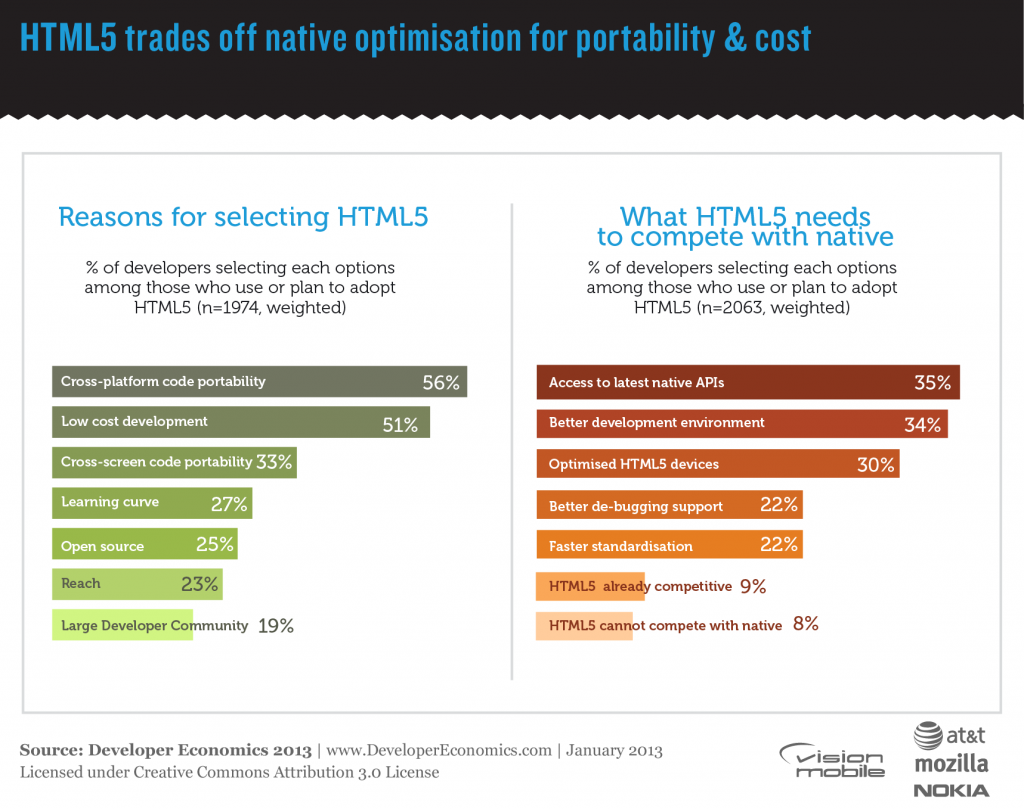

Sebastian’s desire for the tools space was very much in-line with our outlook in the latest developer economics report – consolidation. Fewer SDKs to integrate and fewer monitoring consoles to log into.

King for a day

Finally, if Sebastian could change just one thing about the platforms he works with, what would it be?

Better support for web/native hybrid app development (Lyft explored and abandoned that approach), with the Android WebView particularly in need of improvement, was a close contender but the top of the list for fixing was the Apple App Store review process. 5-10 days of waiting and they can see from their server logs that the reviewer doesn’t even login to the app with Facebook Connect before approving it. There must be a better way.