Andreas Pappas shares our latest findings, from our Business & Productivity Apps report which takes a look at developer opportunities created by emerging trends in enterprise mobility (such as bring-your-own policies and mobile SaaS) and professional and vertical app markets (e.g. healthcare apps). This market was worth $28 billion in 2013 and is set to grow to $58 billion by 2016.

[Want to help us with data for our reports? We’ve just launched our latest Developer Economic survey – take the survey and have your say on the latest trends]

[tweetable]Apps are changing the way people communicate, work and play[/tweetable]. App development has grown into a huge industry, that we estimate to be worth $67 billion in 2013. We expect the app economy to more than double in size by 2016.

Most of the publicity and media spotlights currently fall on superstar consumer apps like Angry Birds or Candy Crush Saga and communication apps like WhatsApp. These success stories have certainly highlighted the massive scale and revenue potential of mobile apps, reaching from zero to tens of millions of users in record-breaking time.

At the same time, a growing audience of prosumer and business users depend on Box, Evernote and Trello to help them be more productive in their work. Enterprises are now allowing employees to use the apps they love at work, inside the corporate Intranet. Organisations of all shapes and sizes are integrating mobile apps within their business processes. This mobilisation creates a demand for off-the-shelf or custom mobile apps and services, translating into new and bigger opportunities for mobile app developers.

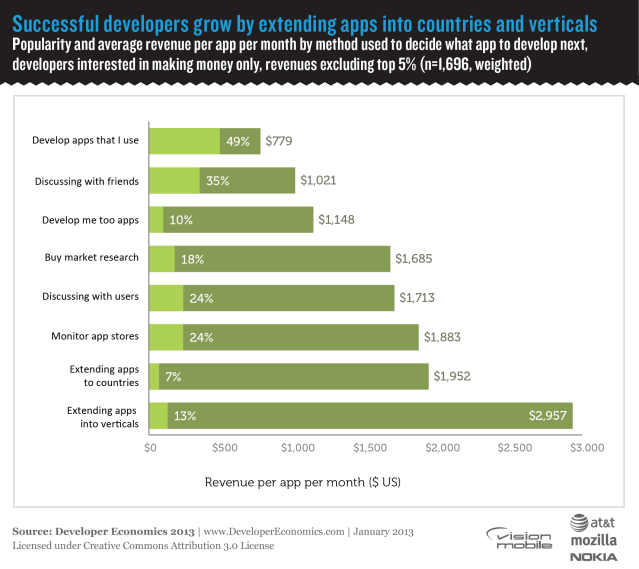

Most app developers currently target consumer app markets (think games and lifestyle apps) but they could be missing out on opportunities in the enterprise (aka business & productivity) market. Our research indicates that the business & productivity app market, is not only growing at approximately the same rate as the consumer app market but is also less congested, and offers better revenue potential, for more developers. Read the report to find out more.

Consumer vs. Enterprise & Productivity apps: how do revenues compare

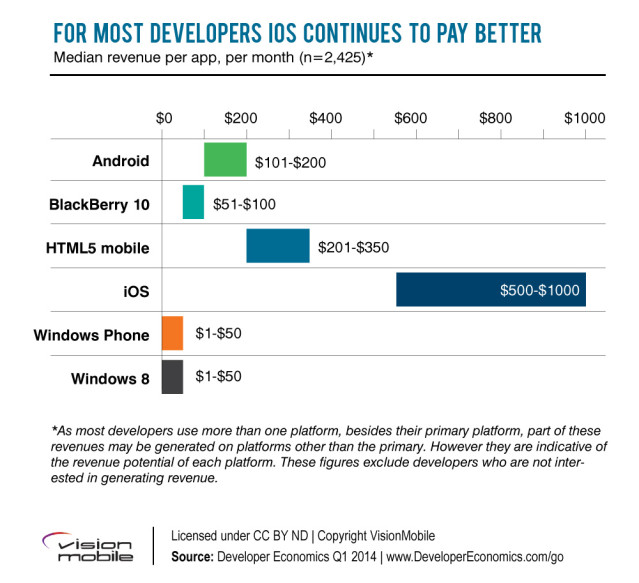

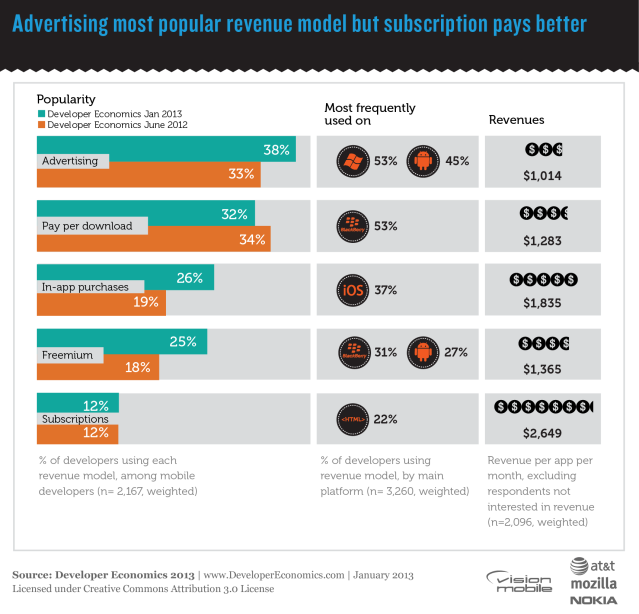

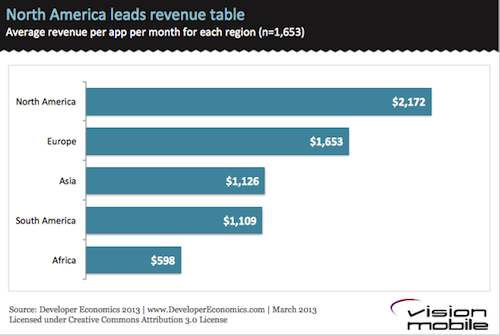

App publishers that target business and productivity markets have a much better chance of generating sustainable revenue than those targeting consumer markets, with just 32% of them below the “app poverty line” ($500 per app per month) compared to just under half of consumer-focused publishers (48%). At the same time, [tweetable]publishers that target businesses or professional users have a much higher chance to generate very high-revenues[/tweetable]: 16% of those targeting the business & productivity market generate revenues exceeding $500,000 per app per month, compared to just 6% among consumer-focused publishers.

While consumer apps and particularly games (e.g. Angry Birds, Candy Crush Saga) can generate extraordinary revenues, it is quite clear that this is not the case for the vast majority of developers that target consumer markets. Business & Productivity apps allow developers to build a sustainable business around more solid business models with recurring revenues from a loyal customer base.

As bring-your-own policies and enterprise app stores become increasingly popular among businesses, the market and the opportunity for developers is likely is set to expand in the next three years.

Which platform should you prioritise if you build business and productivity apps?

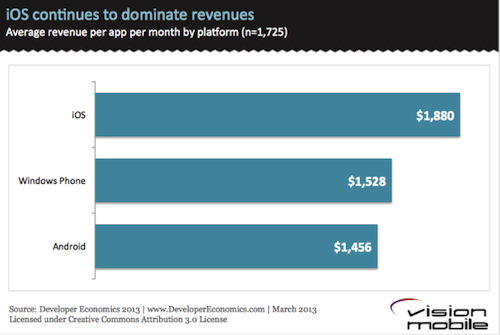

While Android is dominating the consumer market in terms of market share, iOS maintains a healthy lead among professional and business users. Data provided by enterprise cloud content platform Box, indicates that 94% of their tablet users are on iPads, while enterprise mobility management services provider Good Technology indicates that 54% of enterprise smartphone activations came through iPhone devices in Q4 2013. It is clear that Apple has an edge in the business device market and this is also reflected in revenues generated via iDevices: VisionMobile estimates that revenue generated via iOS devices accounts for at least 60% of the total revenue in the business and productivity market.

For developers that target the business & productivity sector it makes sense to prioritise iOS for development over the other platforms they develop for. However, there are several considerations to take into account such as integration with existing enterprise services, which may call for an HTML approach or the specific market that you target.

Where are the opportunities in the enterprise app market?

There is an inherent unpredictability associated with the future use of apps and it is exactly this unpredictability that empowers developers to create innovative apps that continue to redefine whole markets and industries. Nevertheless, we can still identify a number of areas that currently attract considerable attention among businesses and where we see future value being unleashed in the business & productivity market:

Vertical apps

Specialised industry apps such as healthcare, real estate, finance or automotive. Vertical specialisation provides a great opportunity for differentiation and for building strong brands as the app economy diffuses into every single industry. Existing industry stakeholders can leverage apps as a differentiation strategy against “un-apped” competitors, integrating apps and exposing APIs across their product offerings. For independent developers, specialisation is a means to capture a niche and survive the discoverability labyrinth.

Productivity/BYO

Apps that cross the boundaries between private-use and work-use, such as storage, lists, calendars, office-type apps are key drivers behind the consumerisation of enterprise IT. Once into an organisation or an enterprise app store, such apps can spread rapidly within organisations.

Mobile SaaS

Software-as-a-Service, delivering CRM, HR, ERP, BI services to small businesses and large enterprises is a booming sector. Mobile apps extend these capabilities much further by allowing anytime/anyplace access to these core business services.

Custom apps/services

Bespoke mobile solutions delivered outside of app stores will continue to take the lion’s share of revenues within the business and productivity app market. As we discussed, the dominance of this model will erode during the next few years as app store purchases increase among enterprises.

MDM/MAM

Apps and services that tackle security and complexity of the decentralised IT department are already essential for any enterprise that adopts BYO policies. More sophisticated app & device management models, that tackle some of the key issues associated with this trend (e.g. managing private/work services, remote deletion of work content) will continue to be hot areas in the next few years, catering to an increasing number of use cases.

Download our free “Business and Productivity Apps” report to find out more about the developer opportunity in this market and the reason you should be developing business and productivity apps.

Have your say in Developer Economics research

Help us continue bringing you great insights about the app economy and app development. Take part in our 7th Developer Economics survey that is launching today! Help us break our earlier world record of 7,000 app developers that took our 6th survey. Take part, spread the word, win prizes and help us do great research !