Voice communication is one of the core functionalities of every mobile phone. However, telephony is up for a big shake-up, as Internet telephony companies like Skype and voice application platforms like the ones below are challenging century-old assumptions about how people speak with each other remotely. (You can read all about this trend on the VisionMobile blog: here and here.)

Indeed, voice is no longer the domain of telecom operators alone. Voice Application Platforms allow you to make creative solutions that integrate voice communication deeply in your app: as voice messaging, click-to-call, person-to-multiperson, voice search and more.

Voice platforms cater to many use cases

Voice APIs allow developers to integrate voice functionality within their apps, bypassing the telco services that traditionally provided these capabilities. Developers use Voice services to enable a number of use cases such as voice calls, conference calls, video calls, voice transcription, IVR services etc. Telcos such as AT&T and Verizon are reacting to this trend (for over-the-top services) by opening up access to their services via APIs.

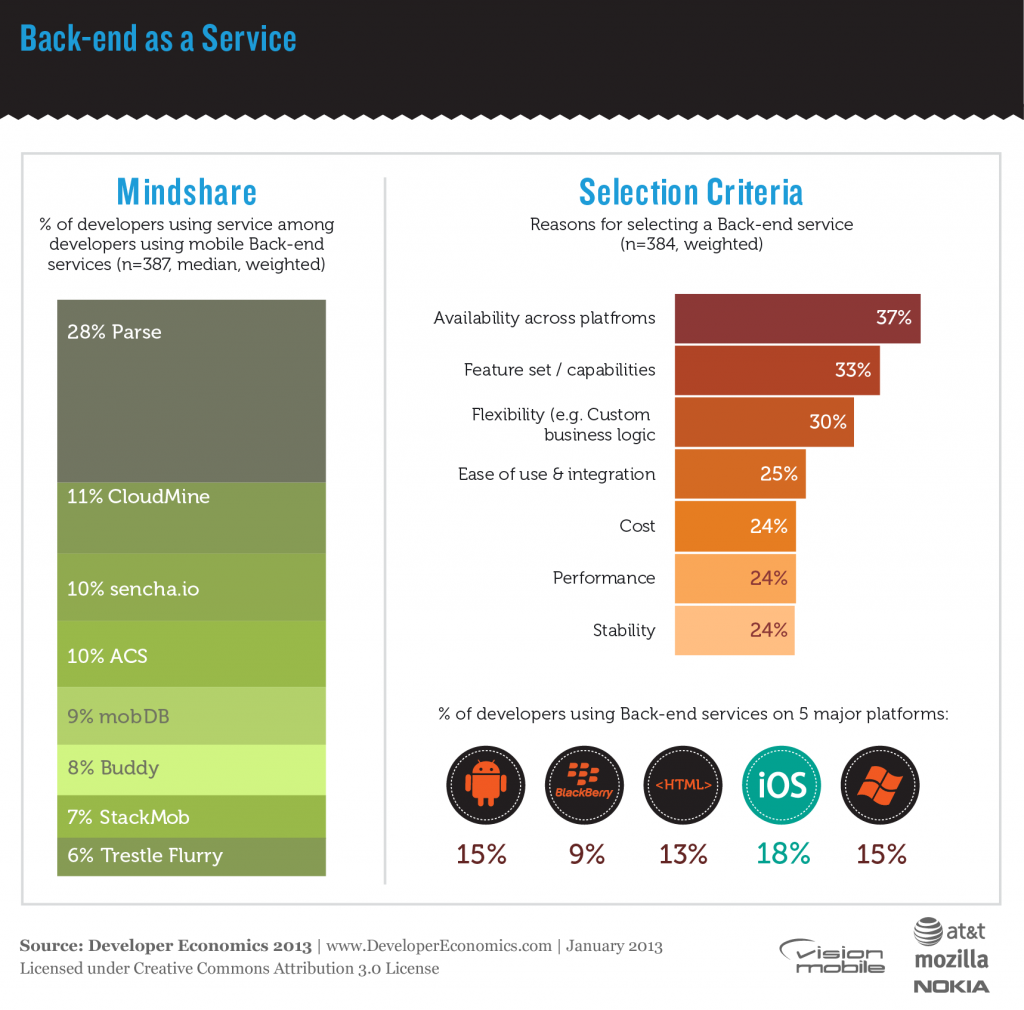

While Voice services cater to a number of different use cases, their use is relatively low among developers because, contrary to other tools in the Developer Economics 2013 survey, they are specialised tools that provide functionality within an app rather than support for the app or the business (as, for example, user analytics or ad services).

The different services surveyed cater to a different mix of use cases, and therefore do not always compete against each other. Developers integrating voice services in their apps tend to use them primarily for enabling voice call capabilities within their apps, including Conference calls (33% of developers utilising Voice services), Outbound calls (29%), and Inbound calls (24%). About a quarter of developers using voice services, are interested in Speech recognition while 20% use them to implement IVR applications. Callback function is also quite popular as indicated by 20% of developers utilising using voice services.

Skype (39%) is leading, with Twilio (31%) following

Skype leads in developer mindshare when it comes to voice services, used by 39% of developers that integrate Voice services within their apps. However, Skype does not provide services through an API but rather through URIs that redirect the user to the Skype client which must be installed on the user’s device. Developers using Skype use it primarily for conference calling (55% of developers utilising Skype), Video calls (43%) and Outbound calls (37%).

Twilio follows at a short distance, utilised by 31% of developers implementing Voice services. Twilio API allows developers direct access to voice services within their apps. Twilio users mostly use the service for Outbound and Inbound calls (43% and 41% of developers using Twilio respectively).

Microsoft Voice services, used by 27% of developers using Voice services, use it mainly for Speech recognition (44% of Microsoft voice services users) and Speech transcription (30%). Telco APIs such as those provided by AT&T and Verizon are less popular (17% and 10% of developers using Voice services), while OneAPI, a joint attempt by telcos to react to the OTT threat, seems to fall far behind at 4%. The AT&T API is mainly used for Conference calls and Callback (36% and 32% respectively). The latest AT&T Call management API, powered by Voxeo Labs Tropo Platform, allows users to link their cellphone number to OTT Voice services provided via AT&Ts API, negating the need for a new phone number. Tropo, by Voxeo Labs is used by 5% of developers using Voice services and is mainly used for Conference calls (50% of developers using Tropo), Speech recognition (41%) and IVR applications.

Quality is still key selection criterion

Most developers (39% of those using voice services) highlighted performance and quality as a top selection criterion for Voice services. Voice quality is not guaranteed on mobile data networks but is critical in most use cases where voice services are used, particularly in real-time voice such as conference calling. While network quality is often out of the direct control of voice services providers, there is still a lot that can be done on the service providers’ side such as optimising encoding algorithms and scaling the architecture of their voice infrastructure. Ease of integration and availability across platforms, the prevailing selection criteria among all third-party tools and services are also important when selecting a Voice services, as highlighted by 35% and 34% of developers using Voice services, followed by cost (27%).

[doritos_report location=’DE13 Article – Voice platforms’]

Which voice services are other developers using?

[toggle title=”Important things to know about this interactive graph”]