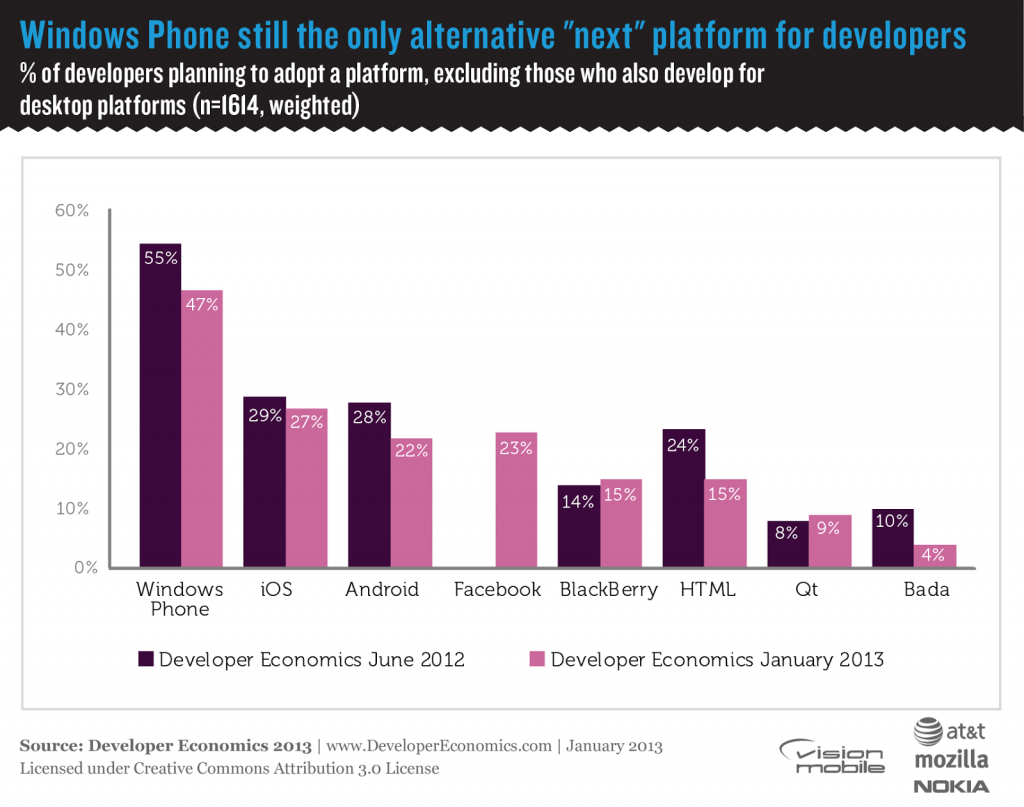

In our 2012 Developer Economics report we included a developer sentiment barometer for the various mobile platforms. As we move into 2013 several new platforms are on their way but all of them look very similar to existing platforms from a developer perspective. We can use this existing data to predict how developers will perceive the new platforms.

Here’s the key developer sentiment table:

Not all factors are equal in generating developer activity

The iOS scores show what really matters to developers in a relatively healthy ecosystem. While learning curve and development cost are important pain points for iOS developers (here developer sentiment echoes the difficulty of Objective C and the cost of buying a Mac to develop for iOS, respectively) and ease of coding and prototyping is poor, there is good access to APIs and reach and revenues are great. As long as those factors stay positive we can expect the iOS ecosystem to continue to thrive.

Android had healthy developer activity in early 2012, mostly due to great growth of the platform and developers’ belief in its future. The good API access has only improved and Google & partners took steps that have significantly improved the revenue generation issues. Android v4, launched in 2012, was the first version to ask users for a credit card on sign-up and the Android Market was overhauled and then relaunched as Google Play. Android looks set to continue to grow developer activity in 2013

Windows Phone lies at the other end of the spectrum. Developers are very happy with the ease of coding and prototyping, cost of development & learning curve, whilst access to features was only average. Unfortunately, although developers enjoy building apps for the platform, reach is bad and revenues are poor. There don’t appear to be any major issues with the Windows Phone Marketplace compared to rival stores and competition for user attention is lower, so we can assume that revenue issues are primarily due to the lack of reach. Although the introduction of Windows Phone 8 has improved access to features, early indications are that it has not meaningfully impacted the reach issue yet. Microsoft and partners have had to financially incentivise a significant amount of the developer activity for Windows Phone and that is likely to continue unless the platform gains much greater traction with consumers.

New Developer Platforms for 2013:

BlackBerry 10

BlackBerry 10 is due to launch at the end of January. From a developer perspective, the platform is cutting off the existing installed base of devices by not providing support for the legacy BlackBerry Java environment. Instead, BlackBerry 10 supports a native environment with an optional Qt-based application framework, an Android runtime and mobile web apps. The Qt platform was very popular with community of developers using it when it was Nokia’s primary environment and the developer satisfaction is reflected in the scores in our table above. It was one of the strongest platforms all round with the main weaknesses in reach and revenue. As the BlackBerry 10 platform is starting from scratch, reach is going to be an even bigger problem there and thus lack of revenue will also be a major concern for developers, despite BlackBerry App World’s historical record in this regard. The addition of the Android runtime gives developers a lower cost entry to a curated app store with lower competition, extending the reach of their existing investment. This suggests the Android runtime will be the most popular option for developers on BlackBerry 10, unless they can get an excellent start to sales of the new platform, driving developers to invest in native apps to establish themselves early with a superior user experience.

Firefox OS and Tizen

Mozilla’s Firefox OS and Samsung’s Tizen are both expected to debut this year and both aim to run mobile web apps as first class citizens. The Firefox OS has some backing from network operators and targets low cost smartphones. We’ll have to wait and see whether Tizen does better than Samsung’s last platform, bada, which had a promising start but little developer traction. Both platforms add more API access for mobile web developers and if they achieve any scale in the market, should also improve revenue generation. Overall, success for either of these platforms should make mobile web developers happier. The key question here is that if the web runtime is not offering a sufficiently compelling user experience on the existing platforms then how likely are web-only platforms to succeed, particularly with lower cost hardware. This strategy didn’t work for Palm with WebOS – can it work in 2013 or maybe 2014? Games are the most popular category of apps and they typically require the performance that only native apps provide.

Sailfish

The Sailfish OS from tiny Finish startup Jolla is due to launch a first device early this year. It’s also pinning its app ecosystem hopes on a native Qt-based application framework and Android app compatibility, much like BlackBerry 10. Developers should be very happy with the technical aspects of these environments. Jolla’s challenge is a lack of resources to get reach and thus solve developer revenue issues. Their plan for this relies on alliances with Chinese OEMs and networks, with western open source fanatics as a smaller secondary market. The ability of this platform to survive depends upon Jolla’s ability to do deals in China far more than their technical execution.

Ubuntu Mobile

Last but not least, newly launched Ubuntu Mobile also has a Qt-based application framework, this time paired with mobile web apps as first class citizens. As you can see from our table this is probably the best combination for developer satisfaction but they currently have no concrete device plans to share and don’t expect anything to ship until 2014. They do have a much bigger existing brand in developing markets than Jolla and theoretically a similar offering (both in terms of user experience and technology).

Developer Platforms: Conclusions

Android and iOS look set to continue growing their application ecosystems. Windows Phone appear to have another year of uphill struggle to gain acceptance. For any of these new platforms to generate developer activity on a similar scale to iOS and Android they need to achieve massive reach. That seems highly dependent upon Chinese OEMs deserting Android in search of differentiation (for all but BlackBerry 10) and consumer acceptance of platforms that, at least initially, have much smaller app ecosystems in every case. We’re not expecting any of these to gain major market share in 2013. If one of them does take off, history suggests that the developers who got in early will have an advantage. However, with so many relatively similar offerings on the way, it’s not clear where developers should invest their effort.