Native advertising is not a recent buzzword.

[tweetable]Native advertising has been around for quite some time in the print and digital world[/tweetable]. Keyword-based search ads on a search results page, or an advertorial in a newspaper supplement are examples of such ads. But it’s only in the recent past that we have seen native advertising on mobile phones really take off. Traditionally, mobile advertising was limited to banner and interstitial ads but these ad formats compromised user experience. Native ads are a step-up from traditional ad formats and are designed to offer an in-context experience to the user.

What Makes Advertising Native

For an ad to be native, these are 3 things that matter – content, form and function.

- Content: Does the ad unit have content that resembles the rest of the content on the page or does it stick out like a sore thumb?

- Form: Does an ad become part of the content screen that the user generally takes notice of, or will it be a part of his blind spot?

- Function: Does the ad unit match the functionality of the rest of the content or elements of the app in which it is displayed?

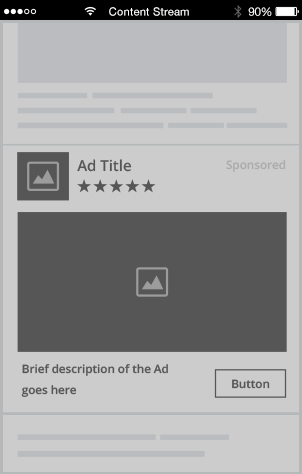

Native ads are deeply integrated into the mobile app. They mimic the look and feel of the content stream in which they are placed. This is completely different from traditional ad formats like banners, which due to their sticky position at the top or bottom of the screen have become a victim of banner blindness.

Consider a news app which has a feed with each news item consisting of a headline and an accompanying thumbnail. The content, form and function framework for native ads will then look like the following:

- Content A native ad in this app should look similar to news feed, which means it should contain a headline and a thumbnail.

- Form The visual elements of the native ad should be the same as that of a news feed. For example, if the thumbnail of every news item has a border, so should the thumbnail of the native ad.

- Function If the news app requires users to scroll for news feed, then any native ad in this news app should also scroll along with the rest of the content.

Native ads sound great, but do they work

While the desktop world boasted of 1 – 2 percent Click-Through Rates (CTR) on native ads, mobile users seem to be more welcoming of this new ad experience. [tweetable]CTRs on native ads are 8X higher than traditional formats and advertisers are seeing 6X higher conversions[/tweetable] [source: InMobi network].

According to research by IPG Media, consumers looked at native ads 53% more frequently than display ads. The study also showed that users visual attention for native ads was nearly equivalent to the visual engagement of original editorial content.

Getting creative with Native Ads

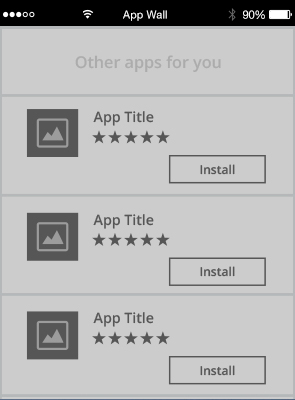

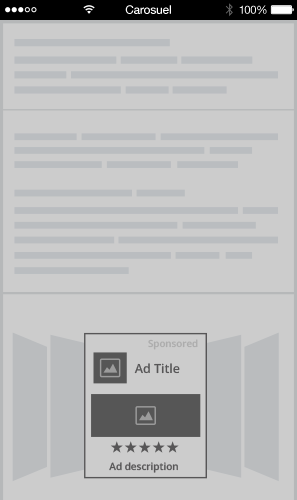

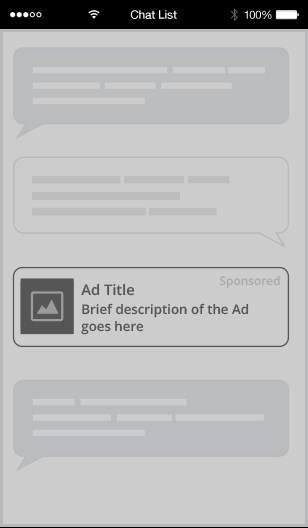

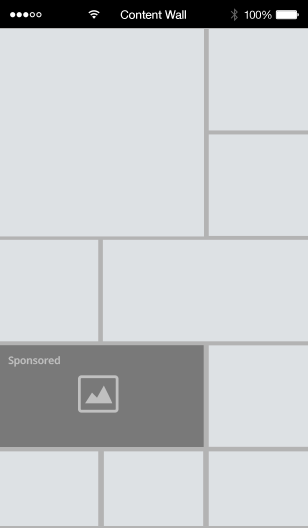

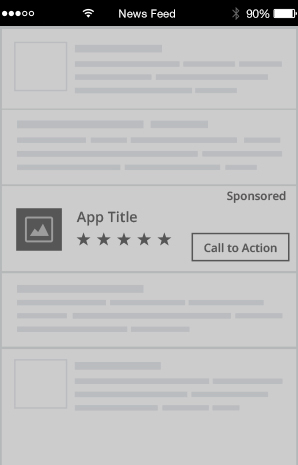

There are a numbers of ways in which publishers can use native ads. The most commonly used ones are the app wall, carousel, chat list, content stream, content wall and news feed.

App wall

Carousel

Chat list

Content stream

Content wall

News Feed

What to look out for while adopting native ads

Native ads are still relatively new to the mobile space and the level of customization offered varies amongst ad networks. Choosing the right ad network is therefore very critical when it comes to using native ads in your app.

Up until recently, native ads were implemented only by publishers with big teams, on a case by case basis with special effort required for every advertiser that they integrated with. The ease of integration offered by an ad network in terms of minimal programming overhead is another aspect to consider when integrating native ads.

Scale is the third thing you should look out for when monetizing your app with native ads. This wasn’t very scalable though. With more ad networks embracing the self-serve model, it is now possible to integrate native ads in your app without significant effort and in a relatively short time.

Focus on the user

The mantra behind native advertising is placing the user’s experience at the center. If not done well, native ads could boomerang on a developer’s monetization efforts. Editorial content and sponsored content (native ads) need to be clearly demarcated. Convention is to mark every native ad unit as an “Ad” or “Sponsored” content to ensure that users aren’t ‘tricked’ into clicking a native ad. As long as publishers and advertisers keep the user’s interests in mind, native advertising is set to transform mobile advertising.